Geek fashion isn’t just about hoodies, jackets, or seasonal wear—it extends to every part of your wardrobe. GeeksOutfit has taken this to heart with their collection...

GuidingCross is proud to present a collection of teen-friendly faith graphic tees that combine style, comfort, and spiritual inspiration. Alongside our trendy t-shirts, we also offer...

If you’re a proud nerd who loves to showcase your passion through your style, GeeksOutfit is your new favorite destination. Whether you’re hunting for festive ugly...

Introduction to Aerospace Fittings Examining the intricacies of aviation safety and performance reveals that essential components are not always those in the public eye. While engines and...

If you’ve been waiting for the perfect time to update your faith-inspired wardrobe, the moment has arrived. The GuidingCross Flash Sale is live—and it’s offering deep...

Power outages are becoming increasingly common, leaving many homeowners searching for reliable backup solutions. Investing in a residential generator offers not only continuity of essential services...

Introduction In today’s competitive real estate market, achieving striking curb appeal is more important than ever. The visual impression your home makes at first glance plays...

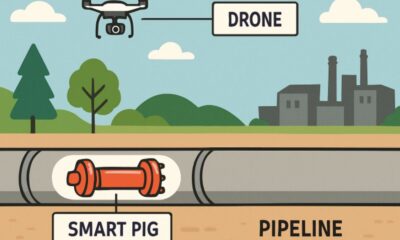

Modern pipeline networks are the arteries of industrial infrastructure, transporting vital resources across vast distances. Ensuring their safe and efficient function is paramount, but as systems...

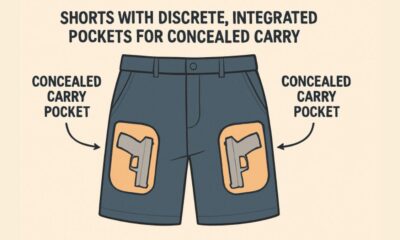

Introduction Finding the perfect pair of shorts for concealed carry goes far beyond style or seasonal trends. It’s a decision rooted in security and practicality, yet...

If your wardrobe already features your favorite geek t shirt or a sharp geek button up shirts collection, you know that geek style isn’t just about...